How would an override impact individual taxpayers?

MELROSE — Earlier this year, Mayor Jen Grigoraitis appointed and convened a Financial Task Force to formulate and propose a Proposition 2 1⁄2 override referendum based on an analysis of the city’s budgetary needs, examples from Melrose’s peer communities, and input from the Melrose public.

Based on this research and preparation, the members of the task force unanimously recommended and the City Council approved, a “tiered” override question, which enables voters to select the level of services they want to support. Those three options are:

• $9.3 million to stabilize services at the current reduced levels, preventing further job cuts for the next 3-4 budget years,

• $11.9 million to partially restore essential city and school services, reversing several significant recent job and program cuts, or

• $13.5 million to substantially restore essential city and school services and positions and invest in additional infrastructure.

Without additional revenues raised by an override, city finance officials forecast more job and program cuts spanning from schools and elder services to road repairs and veterans’ programs. In November, Melrose voters will be asked whether they support an increase in taxes to, at the lowest override level, stabilize the budget and prevent future cuts, and, at the highest option, restore some of the cuts to school and city budgets from the past several years and invest in the city’s infrastructure.

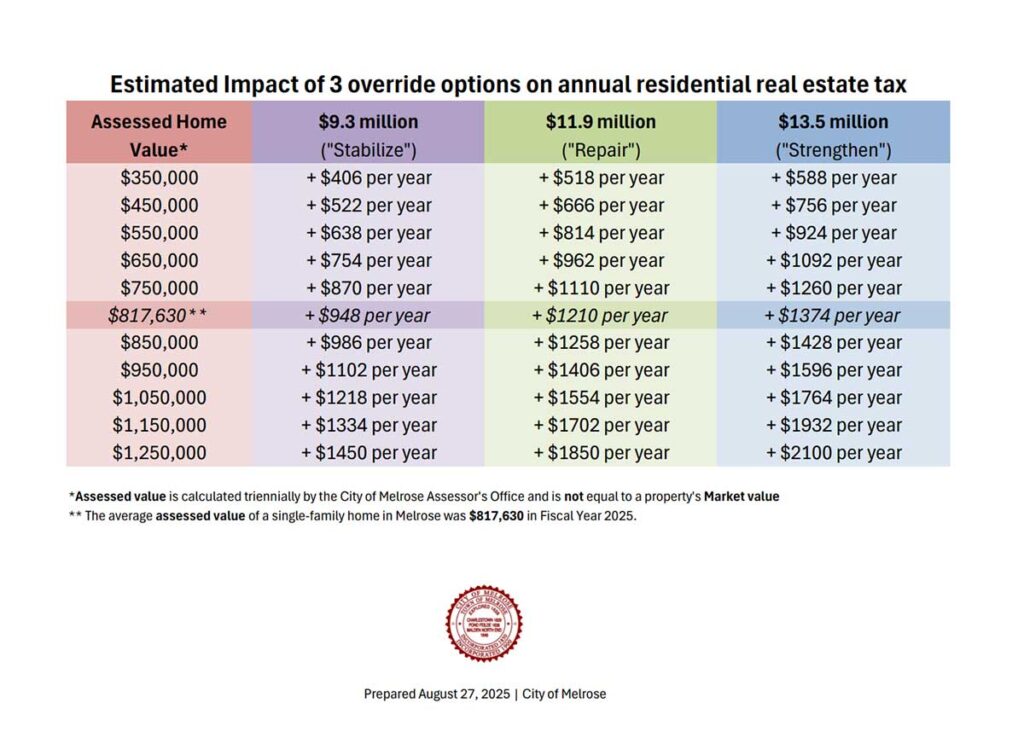

For the average single-family home in Melrose (assessed at $817,630), taxes would increase by $948 per year for the lowest option, $1,210 per year for the middle option, and $1,374 per year for the highest option.

The attached chart shows the estimated tax increase for each override option spanning property value benchmarks.

All property taxpayers should know that taxes are levied based on a home’s assessed value, which is generally lower than the “market” value that can be estimated with real estate websites like Zillow. As required by state law, the City Assessor calculates a property’s assessed value triennially and publishes those valuations at melrose.patriotproperties.com.

The Proposition 2 1⁄2 override will be placed before voters on the November 4, 2025 municipal election ballot.