What cost drivers are causing the city budget to grow?

MELROSE — Earlier this year, Mayor Jen Grigoraitis appointed and convened a Financial Task Force to formulate and propose a Proposition 2 1⁄2 override referendum based on an analysis of the city’s budgetary needs, examples from Melrose’s peer communities, and input from the Melrose public. Based on this research and preparation, the members of the task force unanimously recommended and the City Council approved, a “tiered” override question, which enables voters to select the level of services they want to support. Under a tiered question model, only the highest dollar amount option which receives a majority of votes takes effect. Those three options are:

• $9.3 million to stabilize services at the current reduced levels, preventing further job cuts for the next 3-4 budget years,

• $11.9 million to partially restore essential city and school services, reversing several significant recent job and program cuts, or

• $13.5 million to substantially restore essential city and school services and positions and invest in additional infrastructure.

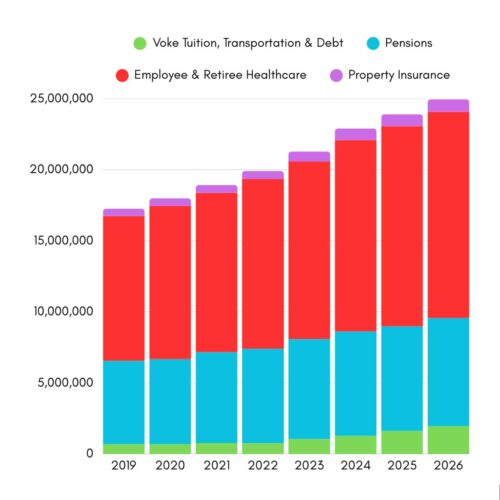

Some residents and constituents have asked why this override is necessary and why the City’s existing revenues cannot provide for its budgetary demands. A number of potent cost drivers have affected Melrose’s budget, including employee and retiree benefits (both health and pension); collective bargaining agreements (over 90% of City and School employees are in unionized roles); vocational school assessments; property and liability insurance rates; and utility costs. All of these costs have increased well beyond the 2.5% property tax levy increase allowed under state law.

For example, in the spring and summer of 2019, electricity rates were billed at about 9.16 cents per kilowatt-hour, and during the same timeframe in 2024, rates were 12.825 cents per kilowatt-hour. At times in the intervening years, electricity rates peaked as high as 33.891 cents per kilowatt-hour. Fluctuations and increases in utility costs such as these have vastly outpaced revenue growth, just as they have outpaced the budgets of many private households.

Melrose is not alone in facing revenue challenges. In February, a joint statement signed by the statewide professional associations of School Superintendents, School Committee members, and School Business Officials asserted that in communities throughout Massachusetts, “expenses are increasing at much higher rates than the revenue available to support them” as part of a “consistent pattern of fiscal pressures across a broad range of communities.” Dozens of towns and cities have sought Proposition 2 1⁄2 overrides in the past several years to address these revenue shortfalls.